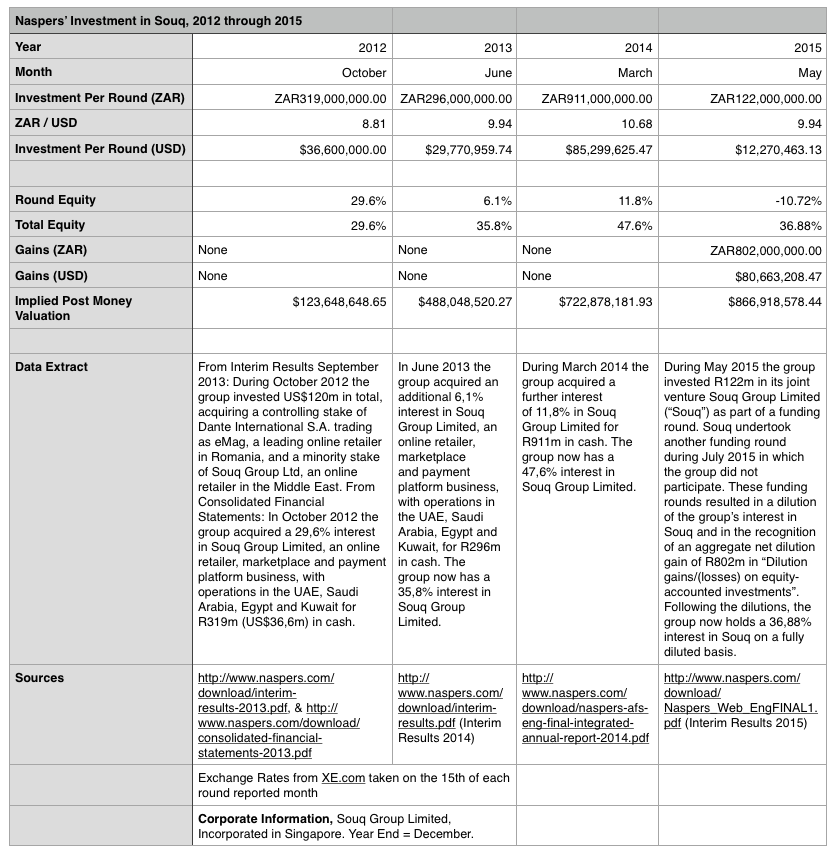

I thought it would be a fun exercise to have a dig through Naspers' publicly available reports and financials to see if I could arrive at a valuation for Souq given their recent mega $275m funding announcement, which if word on the street is to be believed, is a cumulative of funds that have been raised since mid-2015 or so.

I dug back through to Nasper's first investment in Souq that took place in October 2012 and ended at the last available information as of September 2015.

Here are a few highlights:

- Souq's implied post money valuation as of Nasper's last investment in May 2015 was $866,918,578.44.

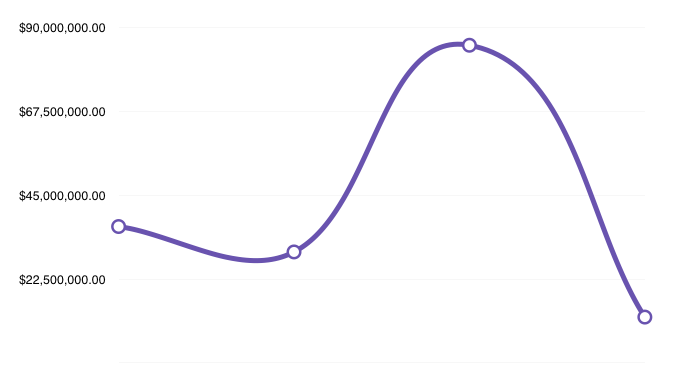

- Nasper's has invested a total of $163,941,048.34 to date.

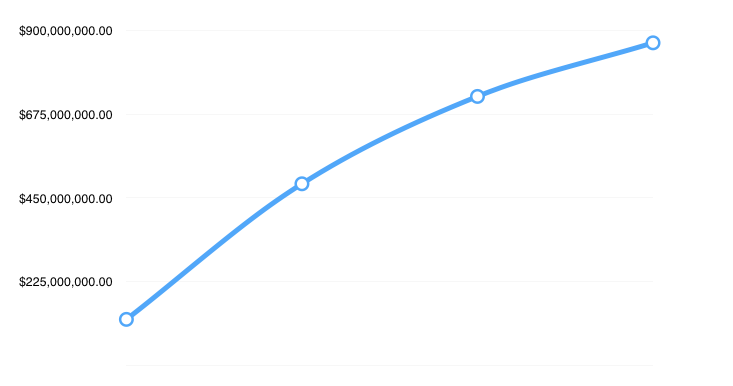

- Souq's valuation has jumped 601% from October 2012 through to May 2015.

And a few charts:

The change in Souq's valuation over time

The change in how much Naspers has invested over time

And here's what you're really after:

Notes:

- The South African Rand (Naspers' base currency) has had a wild ride and its fluctuation has an impact on the USD valuation. For example ZAR / USD was 9.94 on 15th May 2015 but jumped to 12.43 by the 15th of July 2015. That has a material impact on the USD value of the ZAR 802m dilution gain, which in turn has a material impact on the valuation. I've taken the 15th May 2015 number to keep it consistent with the rest of the analysis. The inferior exchange rate actually drives the latest valuation down to under $700m, which is unlikely.

- I also found it interesting that Naspers' latest investment was significantly lower than its previous investments, which generally have increased per round over time. The June 2013 round is a bit of an anomaly, but is not significantly lower than the October 2012 round. While I can only speculate, if I take this together with them stating that they decided not to participate in the the July 2015 round, it points towards a change in sentiment towards the investment. Note that the VC space in the Valley was starting to voice concerns about valuations towards this time. I can't see an investor having invested in excess of $160m allowing themselves to be diluted if everything were bright and rosy. In the same note Naspers' indicated that they decided not to participate in Flipkart's rounds in April 2015 and July 2015, again allowing themselves to be diluted to 14.95%, while taking a nice dilution gain.

Unfortunately it'll be a while before we see more data from Naspers. Their FY ends on 31st March 2016, but they don't report until well into the summer. It's very likely that the additional investment from Standard Chartered (I heard $50m), IFC ($27m) and Baillie Gifford has pushed Souq's valuation to above $1 billion turning it into the region's first unicorn (with rainbows).