Last week brought the incredible news that Talabat, a Kuwait based online food ordering service, was bought out by Rocket Internet for USD 170 million, turning it into the region's largest technology exit to date.

I thought it would be interesting to figure out a revenue based valuation multiple and perhaps attempt a crack at why Rocket said yes.

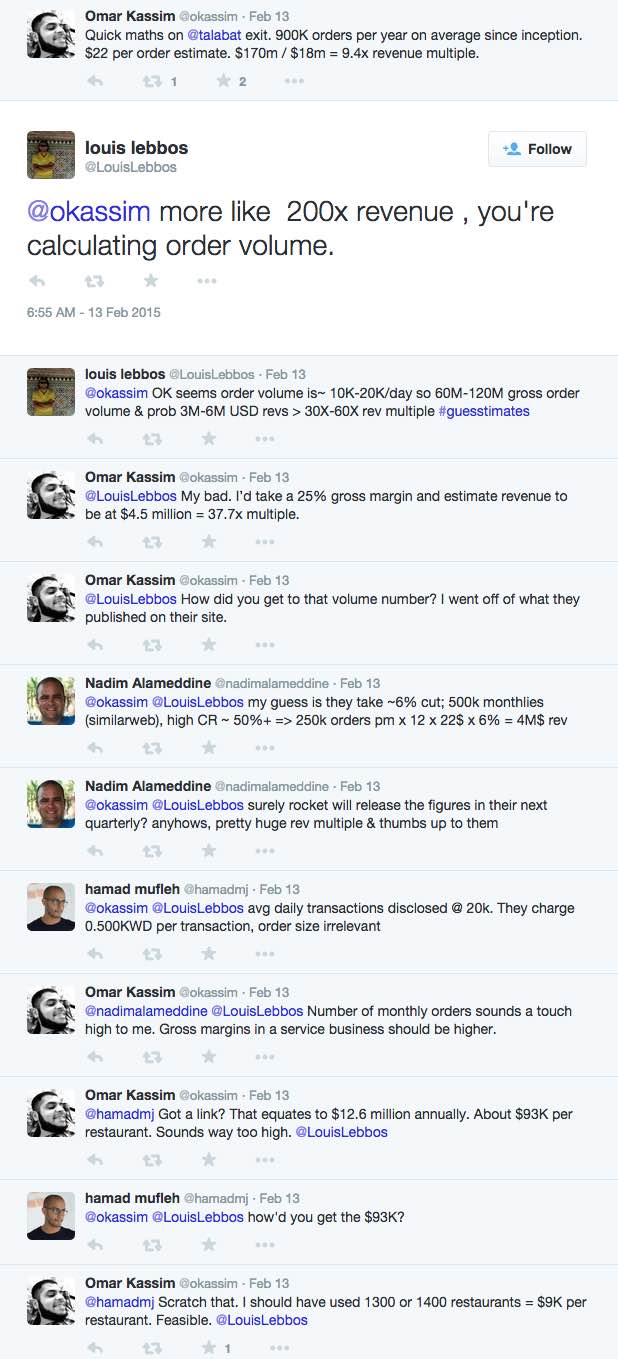

I shared my first poorly put together attempt on Twitter, where it was quickly decimated.

So here's my second attempt:

Order Volume

On its about page, Talabat states that since being founded in 2004, they've crossed 9 million orders.

I found a press release dated 30th May 2013, where Talabat stated that they had crossed 3 million orders.

A Gulf News article dated 23rd January 2014, quotes the CEO of Talabat, Mohammed Jaffar stating that they get 200,000 orders every month, across the GCC.

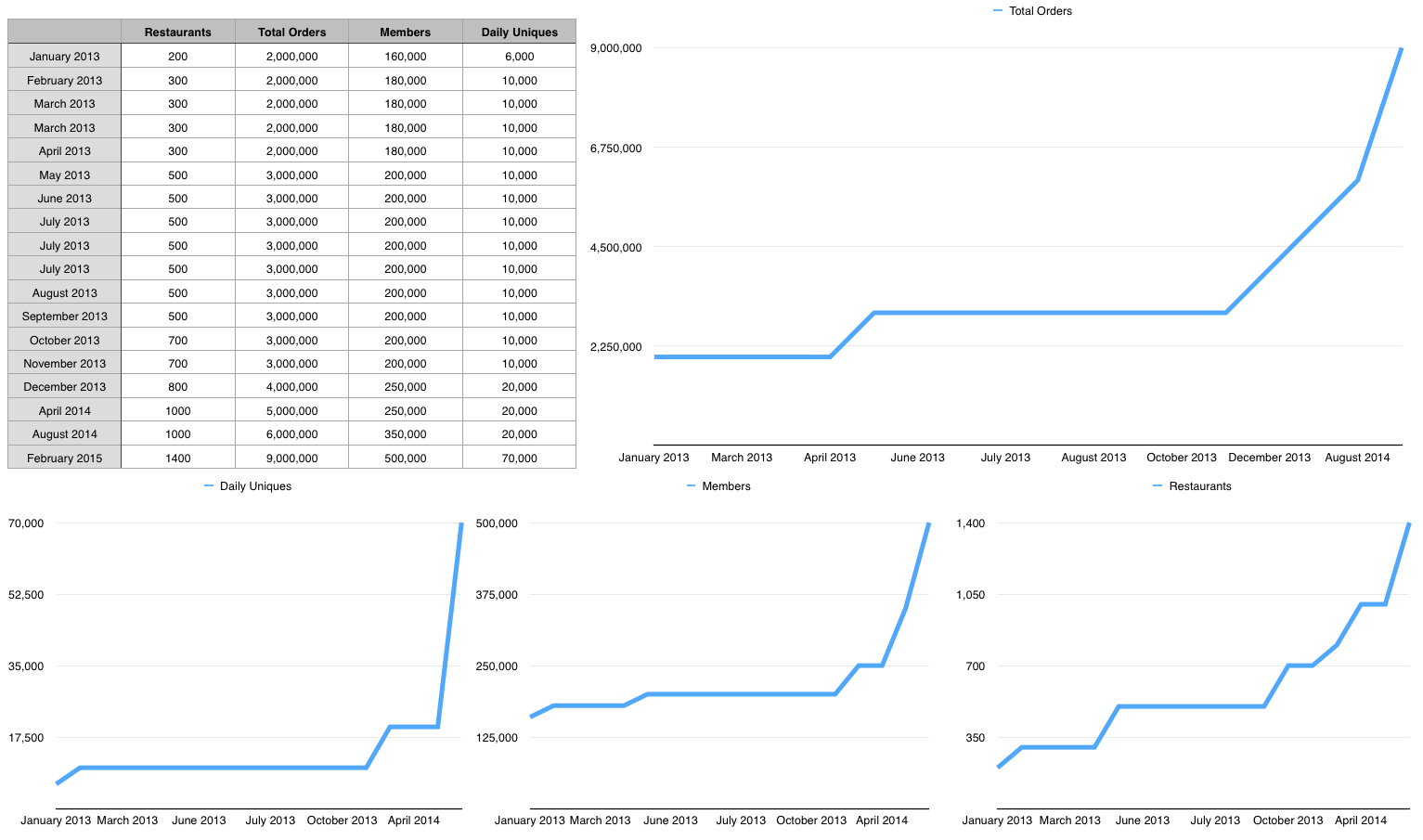

I figured that using the Internet Archive to get snapshots of Talabat's about page may give me a bit more history, which I compiled and graphed for easier consumption.

Mid 2013 to early 2015 was an incredible period, accelerating Talabat from 500 restaurants to 1400 restaurants listed, and driving total orders north of 9 million, tripling volumes over an 18 month period versus it taking 9 years to drive the first 3 million orders.

If you take the entire 11 year period since inception this gives us an average of 900,000 orders per year. However to factor in the acceleration, I decided to use the December 2013 through to February 2015 period and rounded this down to turn it into data for a single year, constituting the whole of 2014.

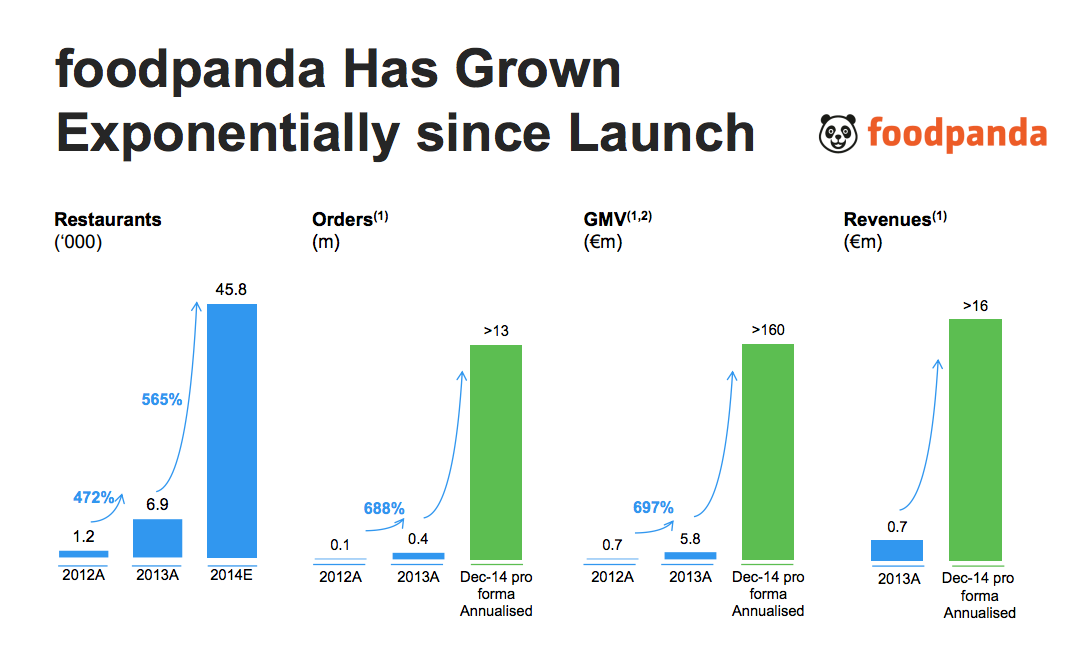

2014 resulted in 5 million orders. Rather than using my previous estimate of $22 per order, I took foodpanda's estimated order value in 2014 as a benchmark (published as part of Rocket Internet's February 2015 business update) resulting in $14 per order at today's exchange rates. I conservatively rounded this up to $15 to account for slightly higher orders values in the GCC given higher disposable income.

foodpanda is an appropriate comparator as Rocket describes it as the market leader for online takeaway ordering in emerging markets. They're currently present in 39 countries and are more Asia centric than Rocket's other large play in the space, Delivery Hero.

$15 results in total gross order volume of $75,000,000.

Revenue

Given that the business is a service, I estimate gross margins in the 15% to 25% range, giving us revenue ranging from $11,250,000 to $18,750,000.

The average number of restaurants during 2014 was 1050. That equates to $10,714 to $17,857 per restaurant. A range that feels a touch high.

Using foodpanda's revenue as a backstop results in a more conservative gross margin of 10%, which equates to a more reasonable $7,500,000 in revenue and works out to $7142 per restaurant.

What is interesting is that foodpanda's 2014 revenue per restaurant works out to $399. This could be due to a variety of reasons such as relative income and the lower cost of food in the more populous markets where foodpanda is present.

It also perhaps indicates why Rocket was keen to accelerate in the Middle East via an acquisition versus growing out and expanding their existing play in Saudi Arabia and Jordan, HelloFood.

Revenue Multiple

Using $170,000,000 as the cost of the acquisition, at the low end of the gross margin range we end up with a revenue multiple of 15.1x, and on the high end a multiple of 9x.

Using the 10% backstop, results in a multiple of 22.6x.

A range of 9x to 22.6x is a large spread, but is at least a 3x premium to rounds that have recently been raised in the region.

Unfortunately the dataset isn't comprehensive, but provides indications as to why Talabat was an interesting target: Strong growth, market leadership and the potential for relatively higher margins from the region.

Hopefully, we'll see a bit more data when Rocket Internet releases their H1 2015 interim data in September 2015.

A great story and an incredibly good sign for the region's technology sector.